Arbitration Dangers Explained by Taras Rudnitsky in TV Interview

» Print This Page- February 12, 2016

- Lemon Law / Car Problems, News

Consumer protection attorney Taras Rudnitsky was recently interviewed by Todd Ulrich, consumer reporter for Orlando’s WFTV Action 9 TV station, about the hidden dangers of forced arbitration. In the story that first aired on February 10, 2016, Taras discussed some of those dangers and how they can significantly affect your legal rights.

Forced Arbitration Is Nearly Everywhere

Most people do not even realize they have agreed to forced arbitration. If you have a credit card, chances are you have agreed to it. Many employers require you to agree to forced arbitration in order to get and keep your job. Many stores and contractors use forced such agreements in their contracts. And, many car dealers include them in their sales contracts. In many cases, the provisions are buried in the fine print where they are rarely – if ever – explained to the consumer.

Early in the 20th century, arbitration was originally envisioned as a way to quickly resolve disputes between very large corporations. The concept was that these large corporations, about equal in size, would prefer this secret procedure, without anyone knowing what occurred. It was often agreed to by both sides, and only after a dispute arose. That way, the process was fully voluntary, and either side could reject it and instead choose to go to court. It has now turned into pre-dispute forced arbitration that you cannot reject.

What is Forced Arbitration?

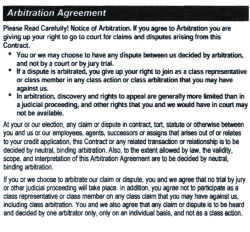

Simply put, forced arbitration means that you have given up your right to go to court, even if a wrongdoer engaged in fraud or violated consumer protection laws. Instead, if you have a claim, you must file it with an arbitrator who is almost always selected by the business. This means that if an arbitration company rules in favor of a consumer and against the business, the business can simply change their future contracts to drop that arbitrator and choose someone else who is friendlier to them. Many people refer to such proceedings as a “kangaroo court”, meaning that the deck is stacked against a consumer forced to go through that process. Some studies have shown that arbitrators rule in favor of businesses and against consumers about 94% of the time. Here is an image from an arbitration clause in a contract:

Car dealers have demonstrated particular hypocrisy on this issue. Virtually all new car dealers in Central Florida use arbitration agreements in their contracts. Although they claim that forced arbitration is actually a good thing, they insisted that Congress write a special law prohibiting car manufacturers from using forced arbitration with their car dealers. Apparently what is good for the goose is not good for the gander, as far as car dealers are concerned.

Dangers of Forced Arbitration

There are also many other disadvantages often associated with forced arbitration:

- Your case is not decided by a judge or jury, but by an arbitrator. There is no requirement that an arbitrator must be a licensed attorney, or even have knowledge about the general subject area relating to your specific dispute. You are voluntarily giving up your constitutional right to access the courts and have a jury decide your case.

- Arbitration can be more expensive than legal proceedings. This remains true, despite claims to the contrary by those who stand to make money from them. For example, an arbitrator often charges by the hour for their time. In contrast, you do not have to pay an hourly rate for a judge or a juror in court, no matter how much time your case requires.

- You don’t have the right to appeal a wrong decision to any court. This means that even if the arbitrator’s decision is legally wrong, you are generally stuck with the result.

- Your ability to obtain information, documents and even identify potential witnesses is severely limited. This means that you may never find additional evidence that supports your claim.

- The proceedings are generally secret. This means that consumers have no way of knowing which businesses have a lot of claims against them. It allows businesses to hide unsavory, and potentially illegal, business practices. And, because they are secret, you typically cannot find out whether the business cheated many other consumers in the same way they cheated you.

- In almost all cases, you give up the right to class actions. This means that a company can cheat thousands of people for a small amount, without having to worry that a group of consumers can get together and collectively sue them in a class action for the same misconduct.

- It may be much harder to hire an experienced consumer lawyer to represent you . Because many lawyers view the arbitration system as unfairly rigged in favor of businesses, they will simply not accept cases that are forced into arbitration.

These disadvantages for the consumer are precisely why some businesses like to include them in their contracts. In practice, the arbitration agreements can often serve as a “get out of jail free” card for some businesses. The politicians in Washington and in Tallahassee wrote these laws to protect big businesses, who are some of their biggest financial supporters, at the expense of consumers.

Is it Hopeless for Consumers?

No, it is not hopeless, for several reasons. First, many of the arbitration agreements we have seen are illegal and unenforceable. If an arbitration agreement is unenforceable, that means you have kept your constitutional right to go to court if you have been victimized. Because of our knowledge of this area of the law, we have had significant success in challenging the validity of certain arbitration agreements, particularly those used by many car dealers here in Central Florida. In those cases, we were able to bring our client’s claims in court, despite the business claiming that we were required to go to arbitrate our claims. Second, the U.S. Consumer Financial Protection Bureau is taking some preliminary steps to restrict forced arbitration agreements. They are doing this by proposing regulations that would limit the effect of such agreements. As you can imagine, powerful corporations are fighting such efforts every step of the way.

How Can I Protect Myself ?

You can – and definitely should – say NO to the companies who try to use forced arbitration provisions in their contracts. Make sure you read the fine print and the side-agreements to make sure you are not agreeing to forced arbitration or forced mediation of any disputes. If an arbitration provision is in the contract, you do not have to sign it. You should cross it out, and tell the business you will not agree to it. From personal experience, we know that some businesses will agree to strike the arbitration provision because they want to get your business. If they won’t let you do so, you should tell them that they won’t get your business. Then, deal with a reputable business that doesn’t require you to agree to binding arbitration.

If you are looking for a consumer protection attorney, and are concerned about your legal rights, you are always welcome to contact us by email or call us at 386-444-3032 for a free consultation. Remember, even if you signed an arbitration agreement, we can help determine if the arbitration agreement is unenforceable, and whether we can still file a lawsuit on your behalf.

Share This